Bubble bath: Beauty acquisitions are accelerating in pace and attracting significant multiples, is the market ready to pop?

In 2018, Business of Fashion reported on the frothy valuations achieved by many beauty brands, tapping into the wary investor sentiment towards the state of beauty M&A.

In 2019, Beauty Independent followed up by covering a speech by Elena DiGiovanni of Indie Beauty Group arguing the same, citing astonishing multiples that were achieved in recent years, including Pat Grath Labs’ 16.7x revenue multiple following a 2018 capital raise, valuing the business at $1bn.

A few years and one pandemic on, we’ve seen continued momentum and spicy valuations, including Shiseido’s acquisition of Drunk Elephant in 2019 (estimated 4.6x forward revenue with an implied EV of $895m)¹, Coty’s majority stake in Kylie Cosmetics in 2020 (estimated 6.6x forward revenue with an implied EV of $1.2bn)² and Unilever’s acquisition of Paula’s Choice (c.6.5x forward revenue with an implied EV of c.$2bn).

The pace of brand launches has not slowed down either. As popular beauty Youtuber RawBeautiKristi lamented in a 2019 video, it certainly feels like brands are launching new products at an unprecedented speed. Over the past six months, makeup’s ‘fast fashion’ brand Colourpop has already released over 30 new collections³ and a handful of celebrities have either registered trademarks for, or launched, their own beauty brands.

For younger generations, the 2021 GameStop rally might be the first introduction to momentum bias in practice, however it also played a significant role in the tech bubble in the late 90s. Valuations in both scenarios significantly diverged from fundamentals (i.e. growth, profitability, cash conversion, and sustainable competitive advantage). While beauty multiples might not be at 90s tech bubble levels, parallels could be drawn to investor behaviour around the beauty sector.

So is the sector overheating?

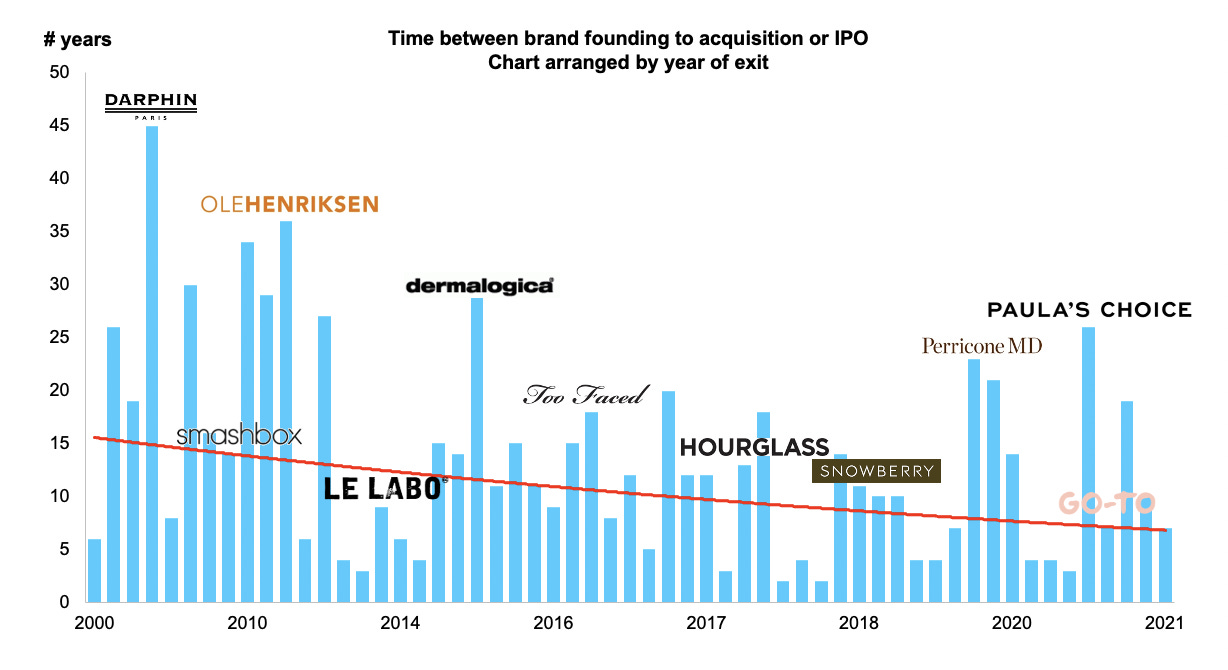

The beauty M&A lifecycle has accelerated over the past decade.

We know trading volume across the sector has increased in recent years, but that’s just the beginning of the story.

The time between the birth of a brand and its eventual acquisition by a beauty corporate⁴ (after rounds of investment in between) has accelerated from around 23 years (2000–2010) to around 11 years (2011–2021). The buyers themselves are a key driver of this trend. In a world where companies need to acquire new brands to maintain and grow market share, I would argue this is evidence of the increasing FOMO building among the top tier beauty leaders.

Ultimately, beauty corporates are justified in their FOMO. In an extremely competitive and crowded market with an increasingly active and knowledgeable consumer, many companies struggle to build meaningful market share growth organically, and thus need to ‘bolt on’ brands in order to grow.

“What we found is that frequent buyers (mostly large companies) grew 63 percent more enterprise value over a six-year period than infrequent buyers of comparable size…In other words, large corporations cannot afford to sit on the sidelines in the acquisition game if they want to remain leaders.”

Shop or drop: the inevitable path for growth in beauty, Kearney

Financial investors are also developing their own FOMO, driven by a hunger to replicate the highly successful exits of TSG Consumer (It Cosmetics) and VMG (Drunk Elephant). Capability across the VC & PE community to flip beauty brands has increased, with several newly established beauty VCs (e.g. True Beauty Ventures) and dedicated investing teams among the top tier PE firms. This behaviour could also be driving the compressed timelines to exit.

Is multiple inflation based on first principles or momentum?

“The median ratio of enterprise value to expected 2019 revenues for beauty industry unicorns — brands valued at $1 billion-plus — stands at 8.8, surpassing software valuations at a median of 7.9. With an estimated $340 million in yearly turnover, Anastasia Beverly Hills’ $3 billion valuation is 8.8X revenue; Glossier’s $1.2 billion valuation is 12X its approximated $100 million in annual sales; and Pat McGrath Labs’ $1 billion valuation is 16.7X its estimated $60 million in yearly revenue.”

The Beauty M&A Bubble Is In Full Effect. Will It Burst?, Beauty Independent

The first stages of a bubble has been described as when investors get “enamoured by a new paradigm”.

The astonishing spend on beauty has been well publicised, but is it justified?

While valuation trends can be observed by multiples struck at the time of transaction, it’s harder to work out whether, en masse, beauty assets have generated the target IRR reflected in the buyer’s original investment thesis. We also don’t know how many of the investments (bar a few acquired by listed companies) were generating positive cash flows at the time of purchase and therefore may have been justified.

We can look to:

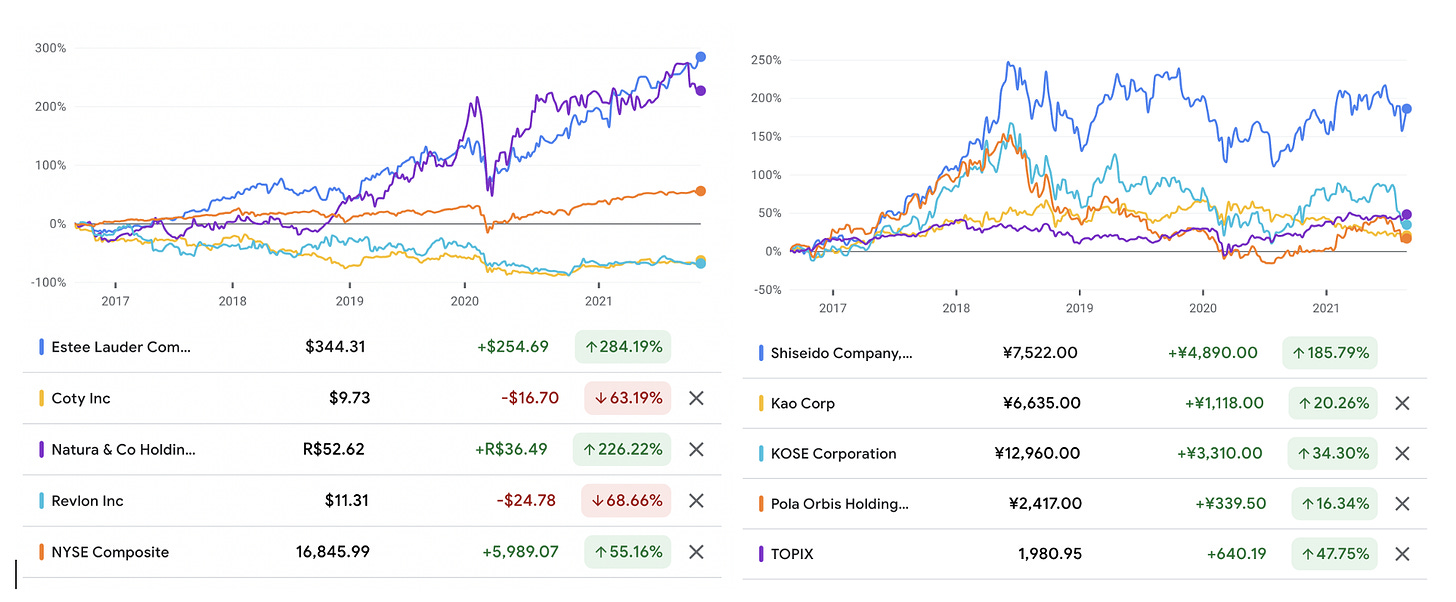

1. Returns achieved in the public markets

Key securities in the sector have delivered impressive returns for investors:

Recently, COVID has only solidified the growing adoration for the beauty sector. While the sector may have been viewed as highly cyclical previously, COVID has demonstrated that skin care, personal care, bath & body are all relatively resilient sectors in the face of a global pandemic, which gives a new contour to Leonard Lauder’s ‘Lipstick Effect’ theory.

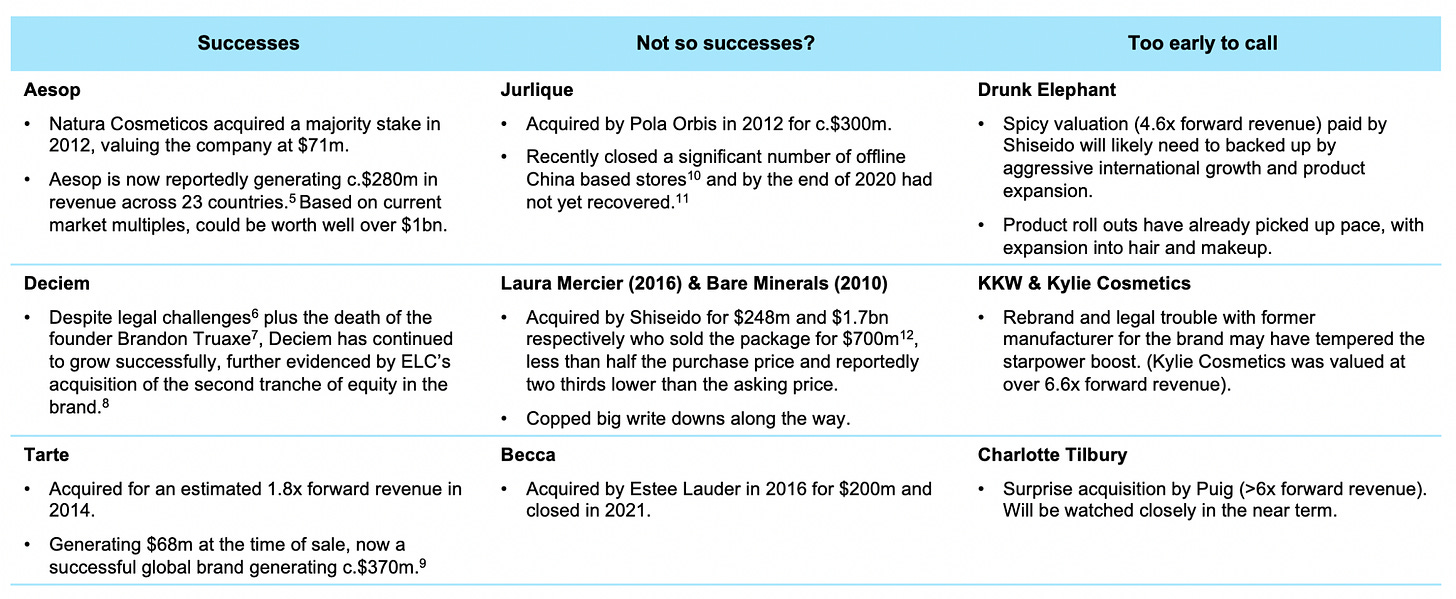

2. Performance reported by former buyers

We can also observe a number of anecdotal success stories (and not so successful stories) that might stoke a justifiable increase in beauty brand valuations:

So are we in a bubble or not?

The question is whether the market has re-rated beauty brands as a result of a sustainable shift the consumer spend and focus on beauty, or whether corporates and investors alike are caught up in the hype.

I’m bullish on beauty…

The beauty market growth has been explosive and most reputable publications continue to predict ongoing strength in the sector. Some argue it’s more about backing the right niche — as Leila Abboud posits in her 2020 piece in the Financial Times. In any case, most brands appear to be achieving revenue growth well above 30% p.a. at the time of sale.¹³

…however some investor behaviour in recent years could suggest a growing momentum bias.

For example, there are signs of increasing tolerance for less profitable plays such as (by my guess only) Glossier, which continues to attract impressive valuations. So how are investors rightfully rationalising the cash burn? Beauty isn’t tech — the product lifecycle is much shorter and we should expect brands to become earnings positive sooner.

Driven by well-publicised success stories and intense market share competition, the FOMO feels palpable between investors and beauty corporates. The outcomes of this FOMO are likely to be 1. A power shift away from buyers to well-funded and high growth early-stage beauty brands and, 2. An inflationary impact on valuations beyond fundamentals. Unfortunately, neither of these are tangibly nor easily observable in real time.

The answer will likely come from key high profile beauty deals over the next 1–3 years. I’ll be keeping an eye on public equities such as elf and The Honest Company, the IPO of Nykaa and Olaplex, Glossier’s eventual exit, ballsy plays like TSG’s 2017 investment in Huda Beauty plus the new consumer focused SPACs like Powered Brands, with hundreds of millions to spend on beauty investments.

Will they stoke investor envy or a tip a panicked sell off? Time will tell.

Correction: Tengram did not exit ReVive Skincare as previously noted in the original version.

¹ Revenue growth at 60% forecast to reduce to c.25% in 2020 according Shiseido’s investor presentations.

² Estimated 40% growth at the time of sale based on Coty investor presentations.

³ Based on my count of their Instagram page.

⁴ For example, Estée Lauder, L’Oréal, Unilever, Shiseido, KOSE.

⁵ How An Australian Hairdresser Built An Empire Out Of Status Hand Wash, Esquire

⁶ Estée Lauder Wins Suit To Rid Deciem Of Its Founder Brandon Truaxe, Forbes

⁷ He Built, Then Nearly Broke a Successful Beauty Start-Up. Can It Go on Without Him?, New York Times

⁸ The Estée Lauder Companies to Increase Its Ownership in DECIEM, press release

⁹ KOSE Corporation Results of Operations, Fiscal Year Ended March 31, 2020

¹⁰ Pola Orbis Holdings Inc Fiscal 2019 Supplementary Material (English)

¹² Shiseido sells BareMinerals, Laura Mercier, Buxom for $700 million

¹³ As estimated based on either investor presentations, high level reporting at the time of sale or public speculation.

A Lipstick Effect

Finance & Strategy observations on the Beauty sector. Based on Lauder’s coined phrase the Lipstick Effect. Opinions my own.

A LIPSTICK EFFECT FOLLOWSSequoiaAccentureFemale Founders FundMediumThe Unilever FoundrySee all (51)